- Category:

Small Business Energy Savings -

Last updated:

December 1, 2023

Direct vs. Indirect Costs: Definitions & Examples

Understanding the difference between a direct vs. indirect cost, and how to use this information in pricing and profit planning, is vital to your small business. Knowing your true costs, which ones are tax deductible, and how to control them, will help you be more competitive and efficient.

Before you calculate and reduce your operating expenses, let’s go over the basics and provide examples of indirect costs and direct costs so you can better manage both.

What are direct costs?

Costs that directly connect to a service, product, initiative or department are defined as direct costs. You can calculate direct costs by each item produced.

Examples of direct costs for businesses

These are common examples of what are direct costs that are typical for small businesses. Many examples of direct costs are variable, meaning they go up and down depending on how much you produce or sell.

- Labor

- Raw materials

- Production equipment

- Storage

- Energy used in production

- Sales commissions

- Transportation

Ways to reduce your small business’s direct costs

Reducing direct costs and examining ways to reduce waste at your business can help you be more cost competitive and add to your bottom line. Examples of direct costs to reduce include:

- Spend less on materials. Source less costly inputs to production and then use them more efficiently.

- Minimize errors. Mistakes in manufacturing waste materials, labor and time.

- Enhance inventory management. Having too much inventory is costly, but running out of either raw materials or finished goods when demand is high is also costly. Getting the balance right is the key.

- Streamline processes. You can save on labor, inputs, time and energy when processes are efficient.

- Become more efficient with logistics. Cut the costs of bringing in raw materials and in distributing finished goods to the market.

What are indirect costs?

Thinking about direct vs. indirect costs, it is items that you must pay for regardless of creating a product or service that are considered indirect. Ultimately, what indirect costs are are the things you need to spend money on to run your company. They’re often thought of as overhead expenses that have no relationship to how much you make or sell.

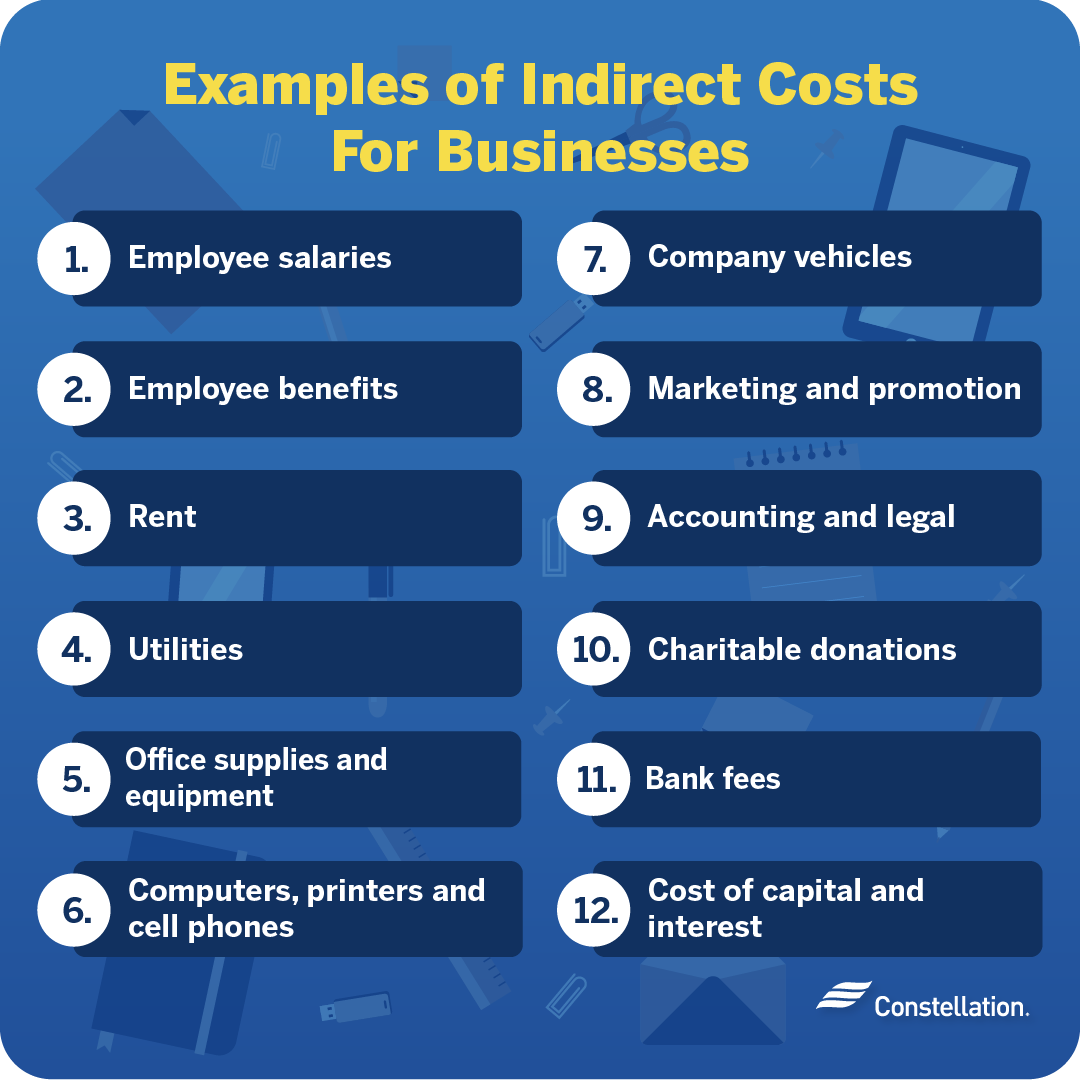

Examples of indirect costs for businesses

Examples of indirect costs include fixed costs that are relatively stable over time. Variable costs change more often according to market conditions.

- Employee salaries

- Employee benefits

- Rent

- Utilities

- Office supplies and equipment

- Computers, printers and cell phones

- Company vehicle expenses

- Marketing and promotion

- Accounting and legal

- Charitable donations

- Bank fees

- Cost of capital and interest

Tips for reducing indirect costs in your small business

You will have little control over some indirect costs. With others, you have many choices for trimming spending. Indirect costs can add up fast, so it is important to keep an eye on them. Here are some ways to reduce spending.

- Permit telecommuting. The cost in terms of space and energy to keep employees on site is high. Many employees work well remotely. In a competitive labor market, take a moment to explore how employee commuter benefits attract and retain talent, as well as reduce expenses.

- Invest in automation. It isn’t easy to find, hire, and retain employees working in repetitive tasks. Explore how to automate your office to save energy while keeping wages at a minimum. You can even extend your capabilities with technologies, such as using chatbots to grow your small business.

- Go digital. Keeping paper records and using paper for communications is costly; not just in the paper, printing, and shipping, but in the human energy that goes into managing it all. Exploring ways to go paperless in your small business can uncover ways to slash spending and reduce waste in your business.

- Switch energy providers. In markets where you can choose your energy provider, you can often find one with lower prices, more flexible plans, and services that best fit your needs. Learn how to choose an energy supplier when switching and then get energy rates for your small business.

- Implement energy conservation guidelines. Eliminate waste to lower your business’s utility bills. Encourage employees to turn off lights in unused rooms. Switch to energy efficient lighting, unplug unused devices and upgrade to low energy appliances.

- Consolidate suppliers. Many of your vendors will offer you better terms if you give them more business. You can bundle your various insurance policies, for example, and get a discount. Other types of businesses may do the same.

Why is understanding direct vs. indirect costs important?

To protect your company’s profits, to keep your competitive advantage and to grow, you need to have a strong understanding of the cost of doing business and producing your goods and services. Knowing what costs are directly tied to what your business offers and what your overhead is will give you insight into what price to offer. And beyond knowing the difference between direct vs. indirect costs, you’ll also have a better handle on planning and controlling spending.