- Category:

Small Business Energy Savings -

Last updated:

February 22, 2022

How Small-Business Equipment Loans Can Grow Your Business

Because most companies use equipment of some type, a small-business equipment loan is something every owner should consider. It might just be a laptop and a phone, but it could be as elaborate as manufacturing robotics. Either way, equipment can be the key to profit and productivity.

The challenge is how to afford new or upgraded equipment when you need it. Sure, an equipment purchase can pay for itself over time, but you still have to come up with the money to buy it upfront. That’s where an equipment loan can help.

What is an equipment loan?

An equipment loan is money lent at interest to your small business so that you can buy the machinery and technology you need to grow or operate more efficiently. Banks offer small-business equipment loans to good customers and businesses that have solid credit. Equipment manufacturers and dealers sometimes also have loan programs for equipment financing.

Because there are so many different types of equipment financing loans — some riskier than others — it’s very important to carefully read through and understand the terms before signing any agreement.

SBA loans for equipment purchases

One of the biggest sources of small-business financing is available through the Small Business Administration’s 7(a) loan program. The SBA guarantees 85% of the principal up to $150,000 and 75% over that amount for selected types of small-business loans.

Because the SBA works through carefully vetted and licensed lenders, your risk is reduced. Too often, small businesses in need of cash fall victim to predatory lenders who add hidden fees, penalties and high interest rates. With the backing of the SBA, banks face less risk themselves, so they’re more able to offer favorable terms for equipment financing.

Popular SBA 7(a) loan options include:

- SBA 7(a) loans. For loans under $25,000, lenders aren’t required to take collateral. The interest rate can vary, as long as it stays under the SBA cap. The SBA makes the decision, in most cases, about extending credit to you.

- SBA Express loans. If time is of the essence, an express equipment loan may be an attractive option. The SBA will review your loan application and make a decision within 36 hours. These loans are riskier for lenders, so only 50% of the principal is guaranteed. The interest rate is still capped by the SBA, and lenders don’t have to require collateral for equipment financing loans under $25,000.

- SBA 504 loans (CDC loans). These loans were created in 2012 to spur business growth and job creation in specific communities and industries. Certified Development Companies (CDCs) are community-based partners who make loans for business expansion and modernization. Long-term financing at a fixed rate can make these loans an attractive way to cover equipment financing costs. Your business must have a tangible net worth under $15 million, and your after-tax net income for two years prior must be less than $5 million.

Equipment loans vs. equipment leasing

An alternative to a small-business equipment loan is to consider leasing the equipment you need. You don’t need to come up with upfront cash beyond a small initial down payment. A traditional equipment loan will require you to pay more upfront.

Leasing can make sense when technology and energy efficiency are evolving quickly. Many leases give you flexibility, so you can upgrade easily. Some leases expedite trade-ins and trade-ups.

If you want to keep the equipment at the end of the lease, many arrangements offer attractive buy-out terms. You’ll end up paying a bit more if you lease small-business equipment vs. buying it. But depending on the lending and lease terms, the difference may be worth it. Efficient operation with regularly upgraded equipment may end up covering that cost gap with energy savings and increased productivity.

What will a bank give you on an equipment loan?

Applying for SBA loans is straightforward. For a standard 7(a) loan, you can borrow up to $5 million with a revolving line of credit open for up to 10 years. For amounts over $350,000, the lender will need to collateralize the loan. You can borrow up to $350,000 for up to seven years under the SBA Express program. Eligibility varies by lender.

The 504 SBA loans are more complex. You must document that you’ll create or save one job for every $65,000 to $100,000 that you borrow. Alternatively, you’ll need to show that you’re contributing substantially to the local economy, bringing new income or development to the area. Expanding a woman-, veteran- or minority-owned business can also satisfy requirements. Certain areas, like modernizing manufacturing, adding robotics or increasing competitiveness globally are program goals. These loans max out at $5 million to $5.5 million and do require collateral. Interest rates are pegged at the current rate for five- and 10-year treasury notes.

You must meet the following requirements to qualifying for a small-business equipment loan through the SBA:

- You must be operating a for-profit business.

- Your company must do business in the United States or its territories.

- You have to have “reasonable” equity to invest.

- You should exhaust other equipment financing options first, including your own assets.

- Most SBA loans require that you have at least two years of business tax returns and have a minimum credit score of around 630.

Many businesses are ineligible, including (but not limited to) religiously affiliated organizations, gambling operations, businesses involved in speculation or lending, and businesses involved in illegal activities. Your business may come under various special considerations, some of which are spelled out on the SBA site.

If you are eligible, here are some examples of what can be purchased with a small-business equipment loan:

Healthcare, dental, veterinary care: Medical devices, diagnostic equipment like MRI machines, IT equipment, lab devices, beds and gurneys.

Construction: Heavy equipment, lifts and cranes, tools, trucks and computers with CAD software.

Agriculture: Tractors, harvesters, milking equipment, processing equipment, irrigation systems, testing devices and transportation.

Food and hospitality: Ovens, kitchen appliances, cleaning equipment, packaging and serving equipment, lighting and transportation.

Manufacturing: Machine tools, assembly line equipment, robotics, software, packaging and shipping machinery.

Offices: Computers, printers and communications equipment, along with furniture.

Real estate: Including staging furniture, IT and advertising.

Retail: Store fixtures, window displays, signage, POS and inventory control systems and other IT.

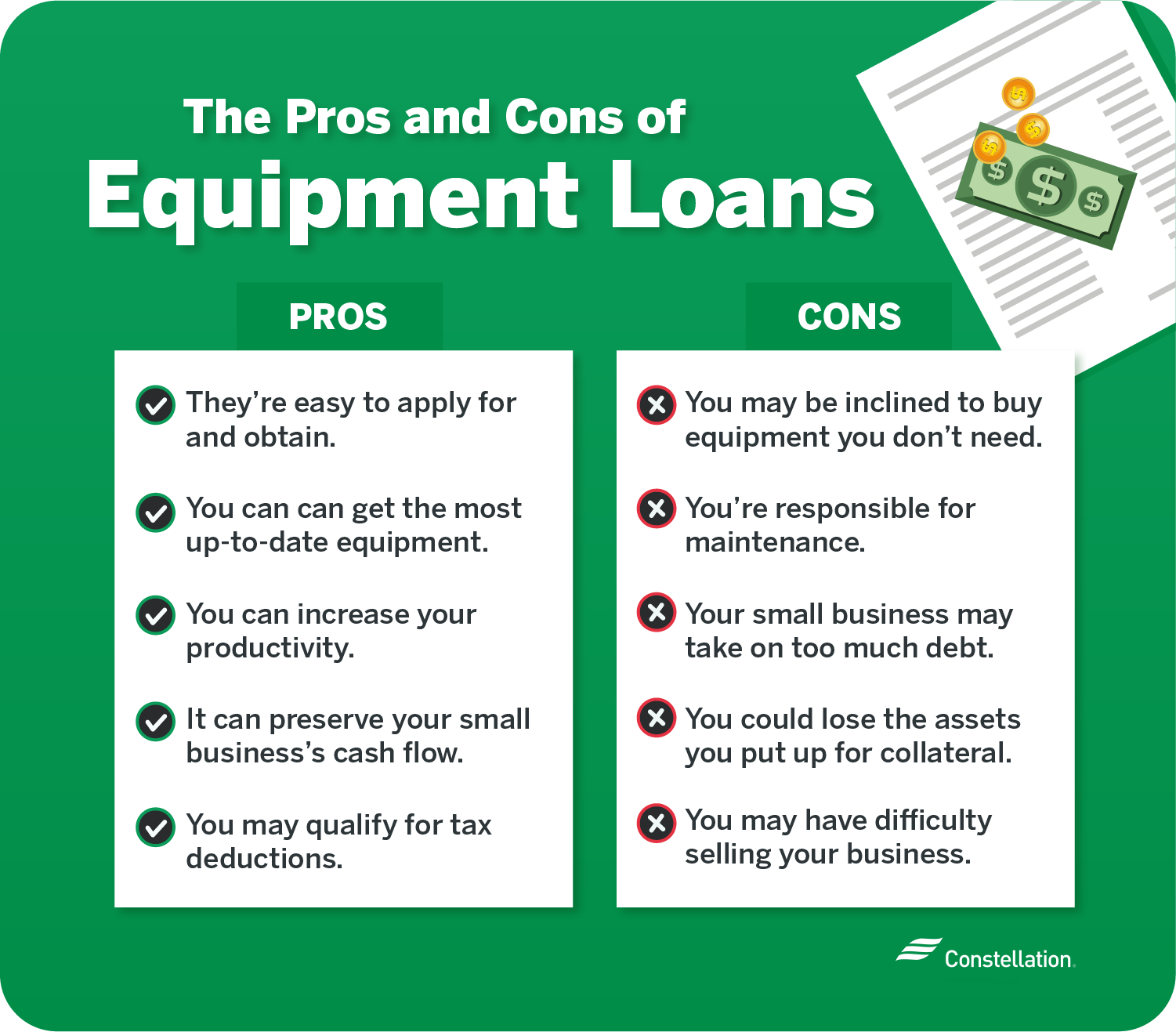

What are the pros & cons of equipment financing?

Getting a machinery and equipment loan can help your business afford the technology it needs to grow and profit. It helps to have the money now for benefits that pay off in the future.

The benefits of equipment loans for small businesses

Getting an equipment financing loan can bring significant benefit to your business.

- They’re easy to apply for and obtain. Standardized forms and SBA backing make equipment financing simple, with fast approval decisions.

- Your small business can get the most up-to-date or energy-efficient equipment. An equipment loan is a way of financing energy efficiency business enhancements that give you benefits now.

- You can increase your productivity. Trying to save to upgrade while running inefficient equipment is time-consuming and costly. New equipment and productivity gains can quickly pay for themselves.

- It can preserve your small business’s cash flow. Locking up equity in equipment means there’s less money for other mission-critical spending. Freeing up your cash flow allows you to address multiple priorities — and gives your business resilience in a downturn.

- You may qualify for tax deductions. New IRS guidance under Section 179 allows businesses to deduct some property as an expense, rather than depreciating it over time.

The risks of equipment loans for small businesses

Every business decision involves some level of risk. Taking on debt can help your business prosper. But the wrong terms at the wrong time — and spending on the wrong things — can hurt your business.

- You may be inclined to buy equipment you don’t need. When you suddenly become flush, it’s easy to be less careful in your spending. Having the cash from a large loan in your corporate account might tempt you to overspend.

- You’re responsible for maintenance. The purchase price is only part of the cost of your investment. Operating and servicing the equipment are costs that you must consider in calculating the total cost of ownership.

- Your small business may take on too much debt. Be conservative when estimating how much more productive your business will be with new machinery. Add cushion for unexpected downturns. (You might qualify for an SBA disaster loan for certain unexpected business setbacks.) The loan that you meant for lifting your business could end up sinking it if you take on more debt than you can afford to repay.

- You could lose the assets you put up for collateral. If you default on loan payments, the lender can seize property listed as collateral, which could devastate your business. You may even lose personal assets.

- You may have difficulty selling your business. If you carry significant debt, buyers may not want to take on your loans. You’ll have less money in your pocket if paying them off becomes a condition of the sale.

How to get a small-business equipment loan

Applying for your loan will be easier and faster if you’re prepared. Working through these steps will also help you determine a safe amount to borrow and improve the loan approval process for equipment financing.

- Check your credit. The most important factor in getting a small-business equipment loan at a good rate is your credit score. If you have a history of late payments or defaults, lenders may consider you too risky. Check all your credit reports in advance and challenge any negative information that you can. Do your best to clean up discrepancies in advance so that your approval is smoother.

- Prepare a business plan. Many lenders want to see your plans for the money they lend. They want to know you’ve thought through a strategy and have limited potential risks. The better they understand your business, the more comfortable they’ll be trusting that you’ll use the equipment loan well.

- Have documents ready. Part of the process for getting equipment financing is proving your business income, documenting ownership of assets and showing that you have enough insurance to protect your business from key risks. Gather and neatly organize these documents in advance to demonstrate your professionalism and trustworthiness.

Small-business equipment loans can be a powerful driver of business growth, efficiency and profit if you plan well and use care. Equipment financing can put the benefits in your hands today while delaying the costs into the future — after you’re already reaping the profits of the investment.