- Category:

Small Business Energy Savings -

Last updated:

June 5, 2024

How to Estimate Utility Costs for a Small Business

Managing business utilities and costs can be critical to maximizing your profit margin. Because utilities make up such a large portion of your overhead, how you manage expenses will impact your bottom line. Being able to predict your business utility bill and benchmarking against the typical utilities expense for a small business will help you in budgeting and business planning.

Whether your business is a startup or you’ve been in operation for years, it’s a good idea to get a handle on the average cost of utilities per month for your small business. The information will help you make decisions that improve energy efficiency throughout the year.

What is a business utility bill?

A business utility bill is a monthly statement of what your business owes to each utility—typically electricity, gas, water, sewage, trash and recycling, as well as communications and connectivity services like phone and internet. Each utility bills your business separately. Most business utility bills include your company name, a contact person, the address and your account number.

The typical business utility bill provides a measurement of service usage and your rate. It might show the current month and compare it to previous months. A business utility bill for electricity, for example, will indicate the kilowatt hours (kWh) your business used along with details on your rate.

You can usually go to the utility’s website or customer portal for a deeper dive into your small business’s utility usage, rates, terms and more.

What are some examples of business utilities?

To be effective with your budgeting, look at business utility examples and compare them to your specific situation. Some are energy-related, but not all. Small business utilities examples include the following:

- Electricity and natural gas. To keep the lights on, run computers and equipment and heat and cool your facility, you need electricity and possibly also natural gas service. Power is often the biggest expense of all business utilities. If your business is located in a state with a deregulated energy market, you can choose among providers and plans to find the best options for your small business.

- Water and sewer. For sanitation, washing up, drinking and cooking, water service is essential. While your business may have access to well water, most connect to municipal water services. Sewer service goes hand-in-hand with water service, as most businesses don’t use septic tanks.

- Garbage pickup. Trash hauling is another of the essential business utilities. Most businesses need regular service for pickup of paper and kitchen waste. You may need specialized service if your business produces bulky or potentially toxic waste.

- Internet. Nearly every business today needs to connect to the web. Many software products are now services in the cloud and email is an essential business communications tool. Access to websites and customer systems are also necessary.

- Phone. Your business may do just fine with cell phones, but many still need landlines with extensions to different people and departments with a key service unit (KSU), or to multiple locations via a private brand exchange (PBX). One alternative to landlines is a Voice over Internet Protocol (VoIP) or IP telephony service. In addition to connectivity, some phone utilities offer voicemail and other communications add-ons.

Understanding the average cost of utilities for a small business

The average utilities cost per month for a small business in a commercial building is $2.14 per square foot, according to the 2018 Office Experience Exchange Report. This is around $125-$1,605 per month in utilities, for 700-9,000 square feet of office space.

As of March 2024, the average cost of electricity in the U.S. for the commercial sector was 12.76 cents per kWH, up from 12.48 cents last year. The average commercial gas price in February 2024 was $10.06 per thousand cubic feet, which is a decrease from $11.97 last year. Your small business utility bill will depend on a number of factors, such as:

- Your location.

- The size of your space.

- The age and number of your appliances.

- The climate in your area.

- The building’s age and energy efficiency.

- Your industry and operational needs.

Lighting and HVAC systems tend to be the biggest power use factors for most small businesses. How much utilities cost for a business like yours will depend on your industry and the specific nature of your work. For instance, energy expenses for major appliances will be higher for a restaurant than a retailer, and a florist is bound to use more water than an accounting firm.

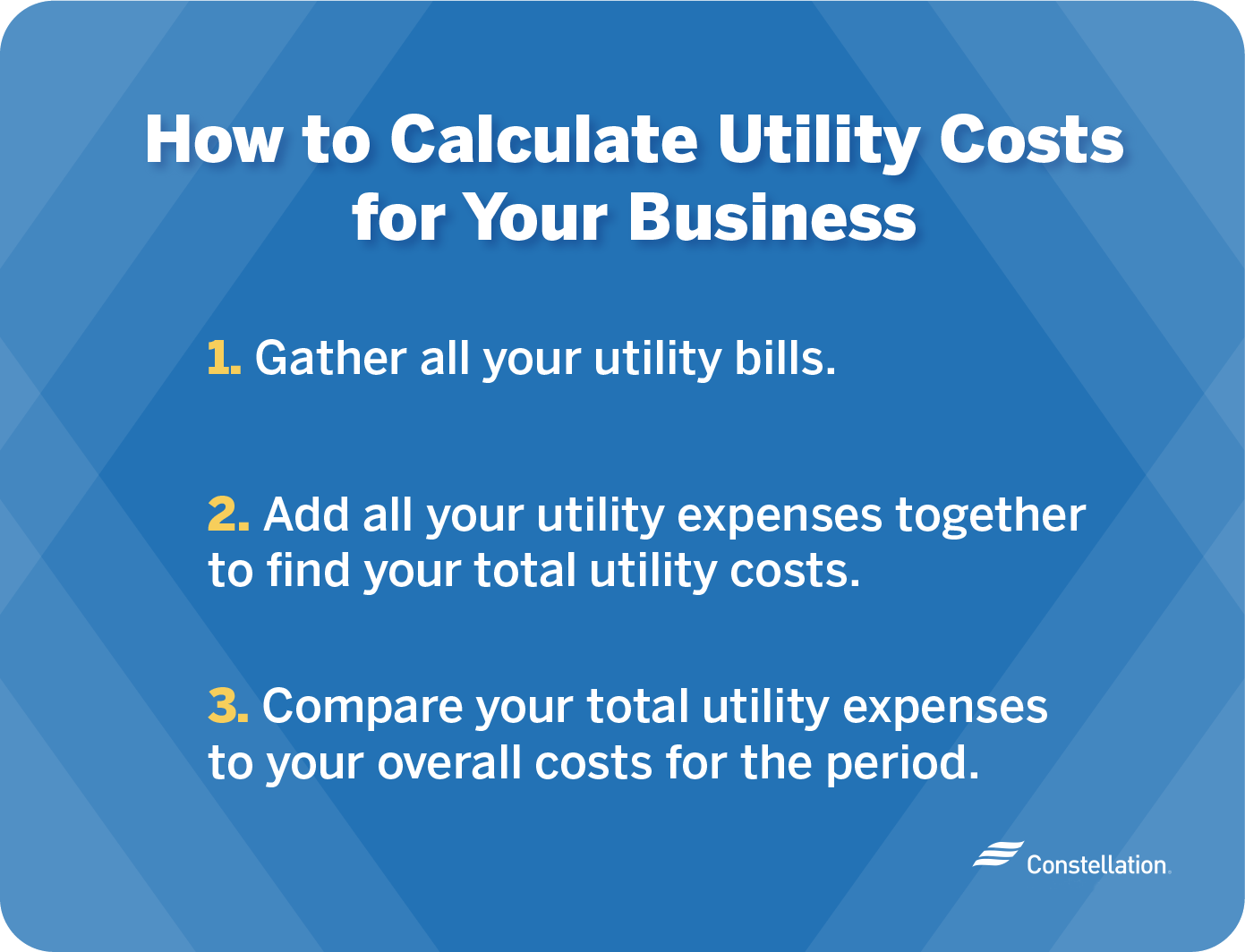

How to calculate utilities expense for a small business

In planning expenses for the coming year, you’ll need to know how to calculate the cost figures for each type of utility. Creating a utility cost calculator for your business is easier and more accurate if you’ve been operating for at least a year, because you’ll be able to use historical data specific to your business. Still, with some research, you can build a utilities estimator for a startup that will help with forecasting and planning. After you’ve been operating for a few months, you can adjust by using your own business utility bill data as input.

The following steps outline exactly how to do this.

1. Gather all your business utility bills

If you have an established business, gather your business utility bills together. Billing periods for each utility may differ. Electricity bills tend to come monthly, while water and sewer bills may be issued quarterly. Ideally, you’ll want at least a year’s worth so that you can capture the seasonal changes in cost. Having two years of bills for business utilities is even better, as it allows you to compare the same month or quarter versus a year ago.

Here’s a round-up of common business utilities to gather:

- Electricity bill. Your business electricity bill will include details about your rate, usage, fees and program details. Keep in mind that your usage may vary month-to-month and by time of day. It may be a good time to think about different options when it comes to plans, if your business is served in a deregulated, competitive market.

- Gas bill. In some areas, your electric and gas services are billed together, but are itemized separately on your bill. In other areas, you get two standalone bills.

- Business water bill. Your water bill is typically separate from other utility bills. Depending on where you live and local regulations, you might see different rate structures like a uniform rate every month, or seasonal rates that encourage conservation during certain months to curtail water usage during drought. Your water bill depends on your type of small business. An office-oriented company uses much less water than a food processing company, for example.

- Internet bill. Your internet bill covers the cost of your business’ connectivity to the web and may include various services, such as a unique email domain. Some companies bundle cable television, phone service and even security services along with your internet service.

- Phone bill for your business. If you don’t bundle phone service with your internet bill, you may get a standalone bill for your phone services and any add-ons.

- Trash and recycling bill. Small businesses’ trash and recycling can include common office trash but also bulky items, valuable metals and toxic materials that include an additional waste disposal surcharge.

What if you’re about to launch a business and don’t have utility bills yet?

If you’re still working on your business plan, you can put together a utility cost calculator by square foot, using publicly available average utility costs by type of utility and business.

You may be able to get cost estimates from utilities before you set up service. Some utilities, like garbage pick up, phone and internet, offer a standard package regardless of office size. Electricity and gas can generally be estimated by square footage. The former building owner or your real estate agent can potentially provide historical business utilities costs, as well.

Another option is to create a utility calculator by zip code, using publicly available data. For example, you can use utility averages by state from this Forbes article, but keep in mind that business energy rates can differ from residential rates. Constellation can give you energy rate comparisons via our website, when you enter your zip code.

2. Add your utility expenses together to find your total cost

Add all your bills, or estimated bills, for your chosen period of time. Special software can help with these calculations, but even basic spreadsheet apps can be effective. Beyond just arriving at a grand total of utility costs, you can also compare monthly, quarterly or seasonal totals to look for patterns.

For instance, if you’re interested in what the business utility costs may be for October as compared to January, you may notice a big difference in how much you are likely to spend on heating.

3. Compare your total utility expenses to your overall costs for the period

Once you’re satisfied with the quality of the data from the utility cost calculator for your business, the next step is to compare the grand total to your overall costs over the same period of time.

Your expense total will be the sum of your total utility expenses plus any remaining business costs, like office space, equipment, vehicles and fuel, payroll, advertising, insurance and other supplies and services.

Comparing those totals can put your utility expenses—especially your energy usage—in perspective. And if you’ve also created monthly, quarterly or seasonal subtotals of overall business costs, you can see the changing impact of your utility expenses over time and budget accordingly.

How to project energy costs vs. total operating expenses, before starting a new business

The U.S. Small Business Administration has several resources that can assist you in projecting operating expenses. Some figures, such as rent, insurance or fees for licenses or permits, will be fairly easy to obtain and plug into your calculations. For other, less cut-and-dry costs, such as payroll or marketing, it can help to reach out to similar businesses for input. Once you have your projected total operating expenses, you can examine how your startup’s projected utility costs stack up against them.

How to calculate your business’ utilities percentage

When examining the cost of utilities for your small business, the calculation should also show it as a percentage of overall costs. You can calculate the percentage of overall costs that are attributed to utilities using a simple online percentage calculator.

If you prefer to make this calculation yourself, follow these simple steps:

- Divide the utility costs by overall costs. You will get a decimal amount of less than 1.

- Multiply that decimal amount by 100 to get the percentage. You can round off as necessary.

For example, if your utility costs for last year were $30,000, and your total operating expenses were $300,000, then 10% of your total operating costs go toward utilities.

You’ve estimated the utility costs for your business—now what?

Congratulations! You now have a good idea of the impact your utility expenses have on your small business. This is valuable information to have as you budget for the coming year, specifically quarter-by-quarter and month-by-month.

You can also dig into that data to look for potential savings. For example, as you break down your energy price, you may realize that your energy plan isn’t working for you as well as it could, and decide to change your energy procurement strategy. Perhaps you’ve been making some common energy-wasting mistakes, like using older, inefficient lighting and appliances. Or you may see how changing your business hours or better preparing for winter and summer temperature extremes could reduce costs.

Why should you track your small business’ utility costs?

Knowing how to calculate the utilities for your business is useful for the purposes of annual planning. But actively tracking how much you spend on utilities, especially energy-related expenses, can also be valuable. There are many benefits of calculating utility costs regularly:

- Make your business more nimble. The sooner you know about changing costs, the sooner you can try to address them. For instance, if you see a spike in the number of kWh your business used in last month’s bill, you might be able to pinpoint the reason and take cost-cutting measures.

- Spur innovation. When you think about a challenge more often, solutions will come to mind more quickly. Many small business owners turn to smart technology to help with automation or monitoring their energy usage.

- Avoid paying for errors. Mistakes happen; even utilities make them on occasion. Paying attention to irregularities in your statements can help you get them corrected immediately and avoid potentially overpaying.

- React more quickly to rate hikes. If you’re just paying your bills without studying them, you may miss price changes that mean paying more money over a longer period of time than if you made an early decision to go with a more affordable competitor.

Once you know how to estimate the utility costs for your business, try to make it a regular habit. That information gives you valuable insight into your operating expenses in both the short and long terms.

The more you know about your costs, the more power you have to keep them under control—like reducing your business’s energy consumption—and ensure that you consistently turn a profit.