- Category:

Small Business Energy Savings -

Last updated:

February 22, 2022

Negotiating Small-Business Lease Renewals

Finding the right location for your small business is important. But business owners who rent their workspace also need to think about how they’ll retain it when it comes time for renewal. By understanding retail lease negotiation, you may be able to secure better contract terms and a more affordable rate when you renew your small-business lease.

What you need to know about commercial leases

Many business owners are currently facing staffing changes, reduced revenue and other significant hurdles. This can make coming up with monthly rent for a small business difficult. As a result, some small-business owners may be feeling uncertain about the future of their commercial leases.

Despite these challenges, there are ways to help make sure your lease renewal process goes as smoothly as possible. It starts with understanding how commercial and retail leases work, as well as some of the techniques for renegotiating leases.

How do commercial and retail leases work?

There are some key differences between commercial and retail leases. A commercial lease applies to properties that are used for business purposes but not for the selling of goods. For example, office spaces, warehouses and distribution centers would all fall under commercial leases.

In a retail lease, tenants are permitted to use the rental property for the selling of goods directly to customers. Some common examples of retail premises include malls, shopping centers and retail stores. Unlike commercial real estate, retail spaces depend largely on foot traffic and walk-in customers for their business.

Commercial property laws

Commercial leases are contractual agreements that offer less governmental protection for tenants than residential leases. Each state — and in some cases, each jurisdiction — has its own commercial property laws. However, they’ll generally include variations of the following:

- Landlord-tenant laws. Landlord-tenant laws are meant to protect the rights of and define the relationship between landlords and tenants.

- Zoning laws. Zoning laws determine how a property in a particular area can be used.

- Disclosure laws. Disclosure laws require landlords to provide information to renters regarding a property’s location, condition and restrictions.

- Insurance laws. Insurance laws outline the type of insurance needed, what it covers and who’s responsible for payments.

Business renters rights

Business owners are granted “renters rights” when renting a commercial property. These rights will vary from state to state and can even vary based on regions within a state. However, some basic renters rights are protected by federal and state law, regardless of jurisdiction:

- Right to a full lease term. Renters have the right to run their business for the duration of their lease as long as they don’t break the terms of the contract.

- Right to privacy. Your landlord can’t prevent you from running your business or allowing guests or customers on the property. They also have to provide reasonable notice before entering the property, except in cases of emergency.

- Right to upkeep of property. Generally, your landlord will be responsible for some degree of upkeep and repairs on the property. The specifics will differ depending on state laws and your rental agreement.

Lease renewal negotiations

Commercial leases may not follow a standard format or agreement structure, so they may look different, depending on the landlord’s needs. When it comes time to have a conversation about commercial lease extension, it’s possible that your landlord will try to suggest changes in their favor.

That’s why it’s important to thoroughly review and understand your small-business lease agreement before renewing. This will allow you to effectively negotiate the lease with your landlord and possibly lock in terms that help transform your business for the better.

The benefits of negotiating your small business’s lease

Although there’s no guarantee of success, the possible benefits of negotiating your small business’s lease could make it worth your while. You may be able to:

- Get a better rate or term.

- Negotiate to have late fees waived.

- Switch to a more favorable commercial lease option.

- Receive assistance with property improvements and maintenance.

- Prevent the landlord from renting nearby units to your competitors.

- Sublease your rental space.

- Negotiate for better terms regarding termination.

- Ensure that your business won’t be relocated to another one of your landlord’s properties.

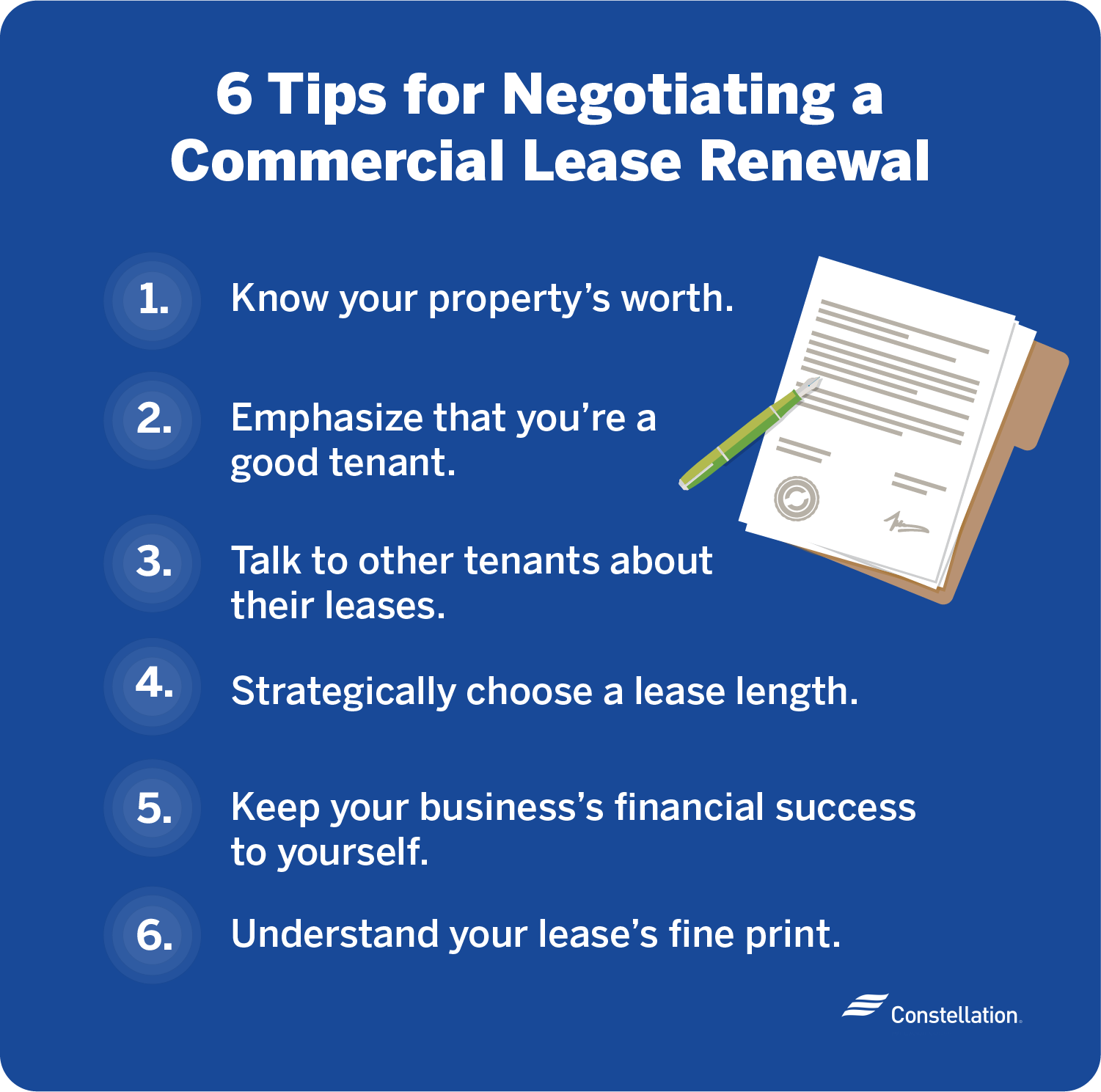

6 tips for negotiating a commercial lease renewal

The lease renewal process becomes easier when you enter the situation prepared. Here are some useful tips to help you better negotiate your small business’s lease renewal:

- Know your property’s worth. Before entering your retail lease negotiation, you should check the going rate for similar office or retail spaces in your area. You may also want to check whether there are similar spaces currently sitting vacant, which can provide leverage to your argument.

- Emphasize your good qualities as a tenant. Landlords value having good, reliable tenants. That’s why highlighting positive traits like property cleanliness and on-time rent payments can help when renegotiating leases. You may even be able to negotiate things like getting your deposit back early upon re-signing the lease.

- Talk to other tenants. If there are other tenants in your building, you may want to talk with them about their current leases. They may tell you about some of the incentives your landlord offered them, which could be useful information when renegotiating your small-business lease.

- Strategically choose a lease length. Although a short-term lease offers more flexibility to move your business, you may want to consider negotiating for a longer lease. You could possibly lock in your rate for longer, as well as potentially lower your rate through loyalty or other benefits.

- Keep your business’s financial success to yourself. It’s possible that some landlords may raise your rent if they know your business has been doing well and could absorb the extra costs. It’s best to keep your business’s financial success private.

- Understand your lease’s fine print. Be sure to read through the fine print of your small-business lease and understand the costs you’re responsible for. To limit your business expenses, you may be able to negotiate a cap on certain costs, such as utilities, property taxes and business insurance. An accountant or real estate attorney can help with this.

Commercial lease options if you’re struggling to pay rent

It’s not uncommon for small businesses to experience financial ups and downs. If you’ve found some business expenses to cut but are still struggling to make rent, there are some relief options available that can help you avoid going into debt.

- Downsize to a smaller space. During your retail lease negotiation, you could discuss the possibility of moving into a smaller property with a lower rent. Just make sure the new space is large enough for your business to operate properly.

- Go digital. If possible, you could try moving your small business completely online. Going digital can help you cut down on your office or retail space expenses, plus you may be able to save money by switching your office hours or going paperless.

- Discuss abatement. If your business’s income has been affected and you’re unable to keep up with payments, your landlord may consider rent abatement, or free rent for a set amount of time. In return, your landlord might try to negotiate a lengthy lease extension.

- Break your current lease. If your small business lease isn’t up for renewal or able to be adjusted to your limited income, there are some circumstances where you may be able to break it. Just be aware that regulations on breaking commercial leases vary from state to state and you may incur penalty fees and/or harm your credit score, if you’re unable to come to an agreement with the landlord.

Can you get out before your retail lease ends?

On some occasions, business owners may try to get out of their lease early. It may be because they need a larger or smaller space to operate their business effectively, or because their landlord has failed to uphold their end of the lease agreement. It could also be that their business can’t generate enough revenue to make rent. In cases like this, it’s possible to cancel a small-business lease prior to your renewal period.

Before you make a final decision, it’s wise to consider the pros and cons of breaking your retail lease. For example, getting out of your lease early could relieve you of rent payments and allow your business to move to a more suitable location. But on the other hand, tenants who want to break their lease could get stuck paying a penalty or fee, and may also harm their credit score in the process. And if your landlord disputes your reasoning, you may have to go to court over it, which may result in you being on the hook for the remainder of your contract plus any court fees.

How to break your commercial lease agreement

You may have determined that breaking your commercial lease agreement is the best option for you and your business. If that’s the case, there are some best practices you can follow throughout the lease-breaking process:

- Review the details of your lease. Your lease may feature a bailout or early termination clause that — under certain circumstances — could help soften the financial blow of breaking your agreement.

- Discuss subleasing or buyout agreements. Even if it’s not currently included in your lease, you may be able to reduce expenses by negotiating a sublease or buyout agreement with your landlord.

- Negotiate a modification to your small-business lease. You could try to bargain for changes like a shortened term length or the waiving of any early-termination fees outlined in your agreement.

- Investigate any breaches of contract. If you can prove that your landlord acted in a way that broke the terms of your lease agreement, you may be able to use that information to help you end your contract early.

- Provide a written notice. Send your landlord a written notice that clearly states your intention to break your lease prior to the date outlined in your agreement.

- Gather your belongings and vacate the space. Be sure to remove all your business’s equipment and clean the property before vacating. This could help you get more of your security deposit back.

Retail lease negotiation isn’t an easy task. But with the right knowledge and information, you can make the most of the lease renewal process. By understanding how commercial and retail leases work, you can better learn how to negotiate commercial lease renewals. You’ll enter your lease renewal negotiations with more confidence. And in turn, you’ll be more likely to negotiate favorable terms for your small-business lease that can benefit you well into the future.