- Category:

Small Business Energy Savings -

Last updated:

September 5, 2025

Inventory Management Tips for Small Businesses

Good inventory management in a small business is vital for satisfying customers, controlling costs and supporting profitable growth. However, supply chain disruptions and new tariffs — over 17% on average — are making it tougher to manage effectively.

Many companies have kept higher inventories than they did before the COVID-19 pandemic, because the old just-in-time inventory model left many companies without key inputs during lockdown. Today, with the threat of tariffs, many companies are rushing to stockpile key inputs and business essentials. Yet having inventory that’s too high can be as financially damaging as not having enough inventory.

Without a good balance, your cash flow can suffer, and you may miss opportunities due to having so much capital tied up in inventory. High interest rates and tight credit can also put you in a squeeze. The average small business still has only enough inventory for 27 days. That’s why understanding how to improve inventory management is so important.

Learning this valuable skill could help you weather unpredictability, protecting profits and operations. Our tips for inventory management can get you on the right path and help you find ways to better budget for your small business.

What is inventory management, and why is it important?

Inventory management is a vital business function. When thinking about small business inventory management, we consider the whole process of ordering, receiving, storing, tracking and controlling goods that are essential to your business operations. Your goal is to manage cash flow and costs while meeting customer demand.

Done wrong, you can swing from out-of-stock situations that send customers to your competition, to having too much inventory, tying up capital in stock or interest payments to finance it. With items sitting in inventory, storage costs mount up, and products can become obsolete or spoil.

Inventory management solutions can help you strike the ideal balance between meeting demand and tying up resources.

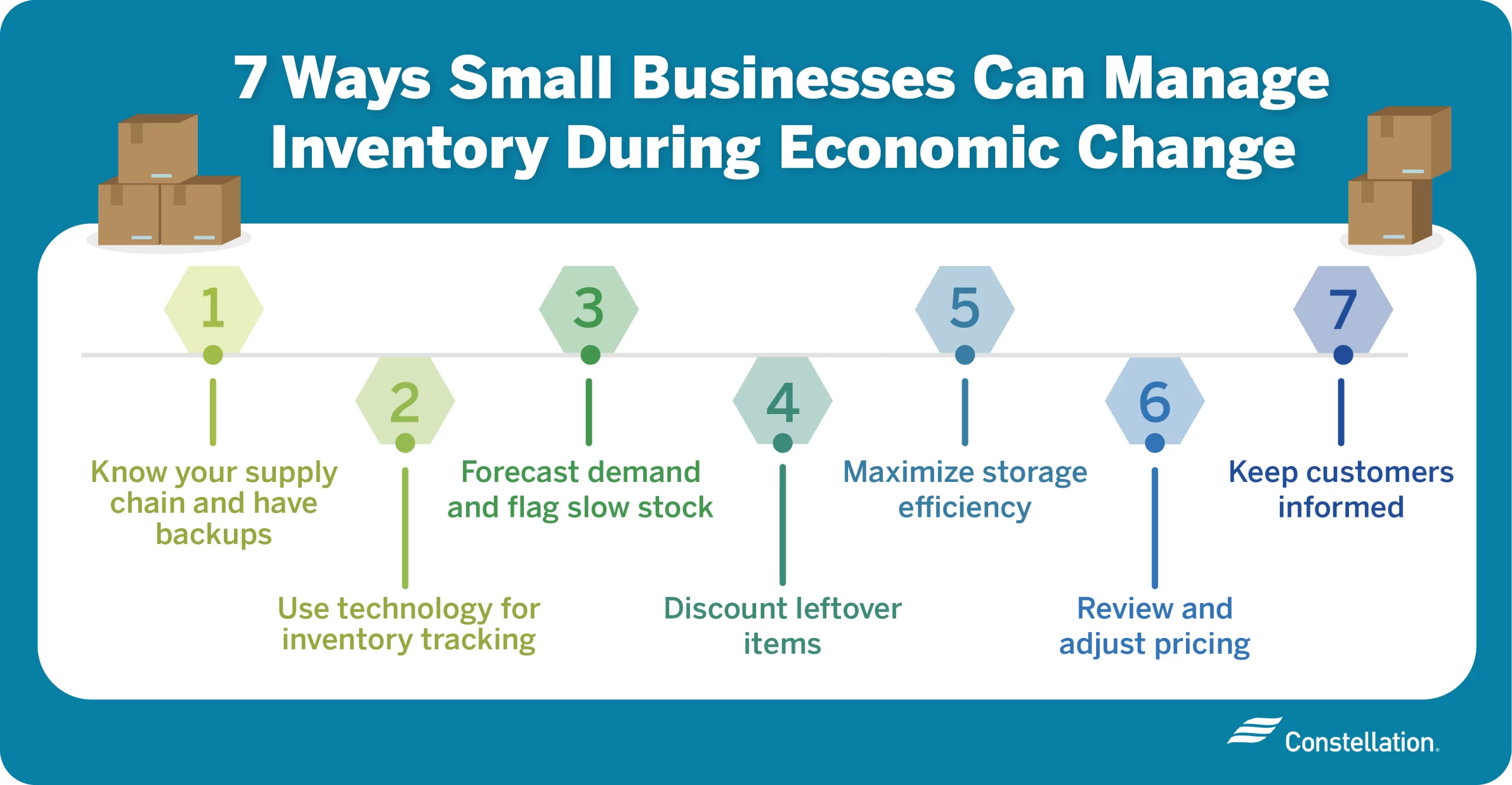

7 inventory management tips for small businesses in a changing economy

These general and warehouse inventory management tips will help you deal with the current shifting economic landscape and the unique challenges you face as a small business owner. Unlike large companies that can bulk purchase and use bargaining power for the best deals, you’ll have to be particularly savvy with a smaller budget and less influence.

1. Understand your supply chain and find alternatives

Take the time to analyze your supply chain. Conduct a formal and comprehensive review of suppliers, intermediaries, tariffs, shipping risks and the disruption potential of single-sourcing. Determine what items and materials are:

- Most critical

- Highest cost

- Difficult to stock

This will help you see where you’re vulnerable and where your costs are concentrated.

Address issues by investigating a diversity of sources. When possible, use domestic suppliers to get the benefits of local sourcing. This reduces the risk of shipping problems, tariffs and other disruptions, while lowering freight costs and shipping times.

2. Use technology to manage your inventory

Inventory management for a small business is easier, faster and more accurate with the use of technology. Trying to do everything manually using spreadsheets and handwritten notes is time-consuming and prone to errors.

The better option is to invest in inventory management software to automate stock level tracking, real-time counts and reorder alerts. Technology enables you to process data to see sales trends that help you predict smart purchase levels. You can also manage inventory remotely and share key information with team members.

3. Forecast demand and identify slow-moving stock

The key to effective small business inventory management is being able to look ahead and predict what you’ll need and what customers will want. Use digital tools that analyze your company’s historical sales to identify:

- Seasonal purchasing patterns

- Recurring trends

- Slow-moving vs. fast-moving inventory items

With this insight, you can right-size your stock at the item level so you don’t tie up too much cash, but still have enough of what’s needed when it’s needed.

The idea is to use data to optimize stock levels, month-by-month and week-by-week, to improve cash flow. That way, every dollar you put into inventory works harder and returns the most value.

4. Mark down prices on leftover inventory

Inventory sitting on the shelf is costing you money. You have cash tied up in it, and you have to pay to store it. You also risk items spoiling, getting damaged or becoming outdated.

One inventory management tip is to adopt a “first in, first out” (FIFO) approach. This focuses on selling older stock before new items come in. You can discount certain items, put them on clearance or bundle them with fast-moving items to clear them out. You can also use a liquidator or sell items on secondary marketplaces to move old inventory.

5. Optimize your storage space

Organizing your storage space is about increasing efficiency. The right layout makes it easier to find items and speeds access. You can also easily visually assess how much you have on hand and what condition items are in. And since storage is a direct cost, you want to minimize wasted space and make every square inch pay off.

Consider the following warehouse inventory management tips:

- Consider upgrades like vertical shelving, easy-access bins, rugged racks and hooks that optimize storage for each type of item in inventory.

- Invest in clear labeling, including details about when items went into inventory and when they expire. Add barcodes on the shelf that connect to your inventory system.

- Consider the costs of maintaining your storage environment. Look at ways to conserve energy in maintaining the appropriate temperature. Replace incandescent lights with ENERGY STAR® LED lights.

6. Evaluate and adjust your pricing

Pricing is a strategic decision. Tariffs, supply chain disruption and competitive pressures can cut into your profit margins if you’re not thoughtful and responsive in adjusting prices. With these fast-changing market conditions, you may need to pay closer attention to prices and change them more often. Consider these tips:

- Monitor your sales data and customer behavior.

- Keep an eye on what your competitors charge.

- Watch for changing costs and look for every opportunity to minimize expenses.

- Make targeted price adjustments based on market demand and competition levels.

The goal is to protect your margins without losing business or customer trust.

7. Communicate changes to your customers

With so many factors adding unpredictability to costs, product availability and delivery times, it’s essential to communicate with customers clearly and frequently. Rather than waiting for them to ask questions or complain, be proactive in telling them what’s happening:

- Explain the reasons behind cost changes and delays.

- Tell them what you’re doing to minimize disruption, such as sourcing locally, finding alternatives and finding less expensive options.

- Use multiple communication channels, including email, text, social media and your website.

An informed customer is often an understanding and patient customer, and likely to stay loyal. Eliminate as many surprises as you can to build trust. You can use these communications as a way to build goodwill and establish yourself as a resilient partner and resource.

Stay flexible and plan for the next market shift

The most important inventory management business tip is to stay nimble.

That means keeping a sharp eye on data, using technology where it can help you see better and move faster, and controlling expenses like storage and energy. Good planning means knowing your options so you’re ready to make fast changes and smart decisions when necessary.

Part of staying flexible and responsive is working with the right partner. Constellation can help you manage your energy costs, and we support you with an extensive small business management blog that includes small business energy efficiency tips. We’re here to help you deal with business challenges and to seize opportunities to grow and profit.