- Category:

Small Business Energy Savings -

Last updated:

July 28, 2022

Energy Efficiency Financing Programs for Your Small Business

Financing options for small-business energy efficiency projects make sense for many companies. Energy isn’t getting cheaper, so looking for ways to cut office expenses can affect your bottom line — in addition to being a good thing to do for the environment.

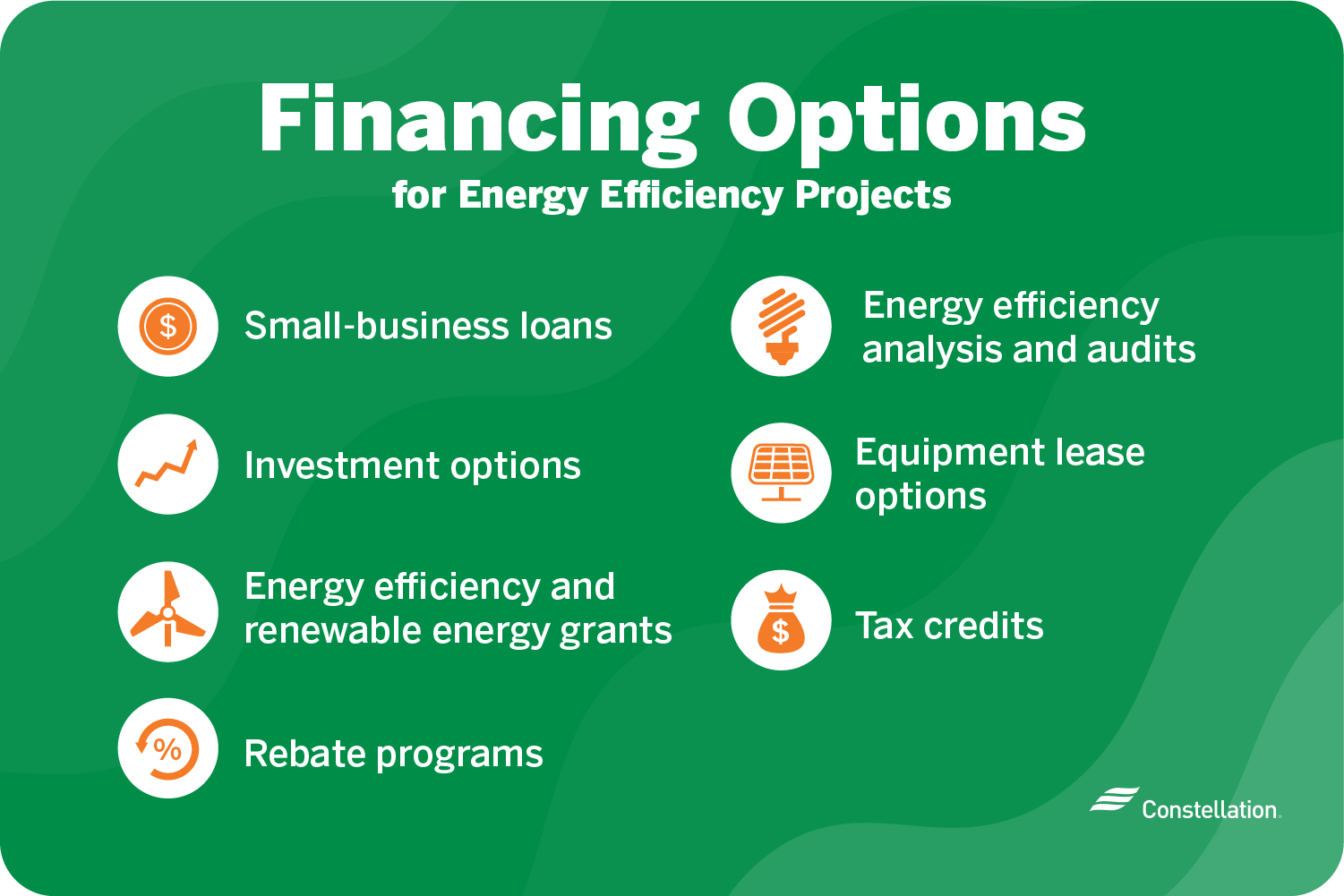

Financing options for energy efficiency projects

Deciding to make your business more energy efficient is easy. Picking among the different programs and small-business energy efficiency financing options is a little more complex. We’ve gathered together some small-business energy saving tips and options for financing energy efficiency projects, along with some considerations and advice.

The following are some of the best energy efficiency programs:

- Small-business loans. You can choose between secured and unsecured loan types. If you can provide collateral, your interest rate may be lower and terms more favorable. With today’s low rates, you may be able to find a zero-interest loan, especially if you have excellent credit.

- Investment options. If the expected returns are substantial enough, you may be able to attract investors. Certain kinds of investment in energy efficiency and renewable energy can earn tax benefits.

- Energy efficiency and renewable energy grants. Some states and government agencies hand out money in the form of grants so that your business can fund energy-saving upgrades. You don’t have to pay back these cash contributions. All you have to do is apply and comply.

- Rebate programs. Government agencies across federal, state and local levels administer a number of programs that give money back to you when you make energy-saving investments. Most power providers offer efficiency credits of some kind.

- Energy efficiency analysis and audits. Taking an in-depth look at your assets and usage can turn up low-cost and no-cost changes. You can also discover major projects that require significant investment. Audits find areas for improvement, and analysis helps predict costs and savings so that you can prioritize and budget.

- Equipment lease options. Leases allow your business to be energy-efficient without purchasing needed equipment. Options include simple leases, where equipment is returned at the lease’s end, and lease-to-own structures.

- Tax credits. Energy efficiency programs for business often include tax credits that can make certain investments extremely attractive. Tax credits are dollar-for-dollar reductions on taxes owed.

How energy efficiency programs benefit your business

Small-business energy efficiency financing options make transformative investments possible for many companies. And improving energy efficiency is one of the best ways to cut small-business costs and streamline the operation of your business in ways that pay off now — with the added benefit of saving year after year. These small-business cost cutting ideas bring benefits that also apply to an energy-efficient home office.

1. Minimize and reduce office energy costs.

You can lower office energy costs by reducing the use of heat and air conditioning and by financing energy-efficient LED lighting and ENERGY STAR® equipment like computers, monitors and printers. They use energy more efficiently and power down automatically when not in use.

2. Replace old equipment and increase business productivity.

Small-business energy efficiency financing can be used to replace old manufacturing and office equipment. These mission-critical machines tend to run all day, so switching them out can significantly affect the energy efficiency of your business.

3. Lead by example and promote energy efficiency or renewable energy.

Making changes in your own energy consumption can inspire other businesses in your community to work toward similarly efficient use of energy and the adoption of renewable energy technologies. Your business can become an ENERGY STAR® partner with state and local governments to access best practice insights and connect with experts and providers.

4. Build your reputation as an energy-conscious business.

Establishing a reputation for energy efficiency is good for business. Both customers and partners appreciate working with companies that are stewards of the environment and that run eco-friendly businesses and sustainable workplaces.

5. Set goals and track improvement over time.

As part of your energy use audit, you’ll analyze and prioritize options. Developing a small-business sustainability plan should include specifying measurable goals and milestones to track savings as your investment pays off.

6. Improve the value of your office building and company assets.

Energy-efficient corporate assets, from real estate to equipment, are more valuable, with lower operating costs, maintenance savings and better terms when financing.

What kind of energy efficiency programs are out there?

As you explore your financing options for small-business energy efficiency programs, you’re sure to turn up a wealth of opportunity. You can find literally hundreds of energy loans for buildings and equipment, grants, rebates, small-business energy options and tax credits.

Two great places to start are the Small Business Administration’s State and Local Energy Efficiency Programs listings and the DSIRE® index, funded by the U.S. Department of Energy at North Carolina State University. You could also look into SBA loans, which are given by the federal agency to companies seeking to buy energy-efficient equipment, use alternative fuel for vehicles or retrofit buildings.

Ready to get started? Make sure you know the rules

There’s money on the table to finance energy efficiency programs for small businesses. All it takes to get started is to do some research to find programs that fit your needs and goals. Know the rules and processes for each program to ensure that your application complies and that you can successfully secure financing for the energy efficiency programs in your plan.