- Category:

Small Business Energy Savings -

Last updated:

October 1, 2025

Small Business Budgeting and Forecasting for 2026

Budgeting for your small business in advance of 2026 will help prepare you for the coming challenges.

Rising costs, regulatory changes, tariffs, supply chain challenges and an evolving competitive landscape make the future hard to predict. Putting together a clear financial roadmap helps you think through potential risks and ways you can prepare for them.

Small business financial forecasting is an essential tool for building resilience into your company. By setting realistic budgets, keeping an eye on trends and thinking through possible disruptions, you can make smarter decisions and maintain a competitive edge.

The small business forecasting strategies and tips in this article could help you set your 2026 budget and continuously adjust it through the year to thrive, no matter what’s ahead.

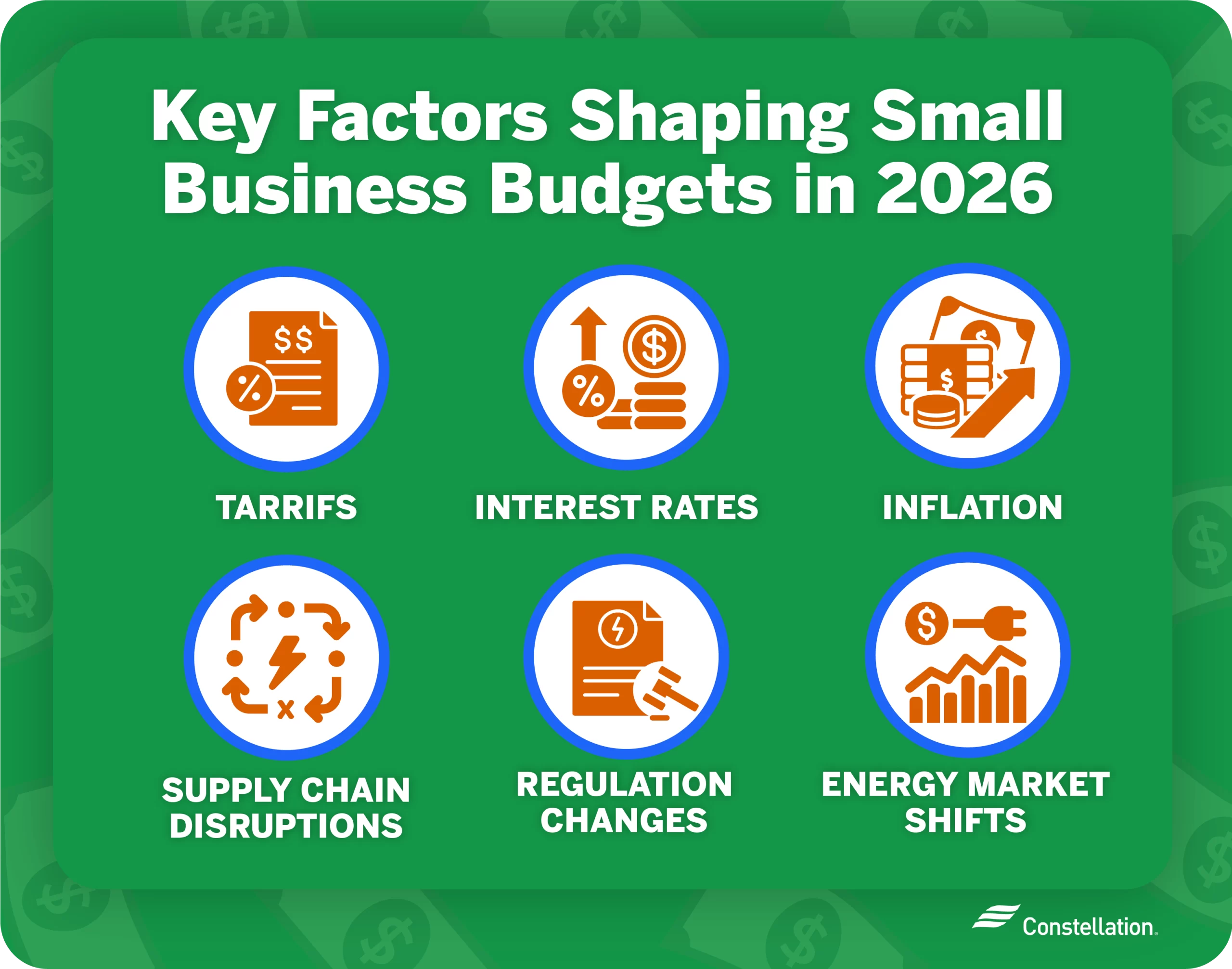

Why 2026 will require careful financial planning

Doing small business forecasting for 2026 and revisiting and revising your budget as the year goes by will give your operations agility and resilience for rapid and unpredictable change.

- The uncertainty of tariffs and their impact on your business can affect your ability to offer competitive prices or protect your profit margin.

- Interest rates and inflation may affect your costs and customer demand.

- Supply chain disruptions, regulation changes and energy market shifts also bring risks.

You can start your year-end planning now by reviewing your 2025 year-to-date data. Look at how various issues have affected your business so far and what trends might impact your future.

While next year won’t necessarily be like this year, starting with current figures gives you a strong foundation for putting small business planning strategies to work.

7 strategies for your 2026 small business budget

Taking lessons from past performance and thinking through future trends and risks may help you forecast accurately. The following small business budget tips could set you up for a strong start and put you on a solid footing so you can better adapt throughout the year.

1. Reference historical data to establish a baseline

Look at data from previous years to help you set a baseline for small business forecasting. The past several years of revenue and expenses will show trends, patterns and seasonal fluctuations. These may include:

- Increased sales at the end of the year

- Spiking energy costs in the summer

- Inflationary cost trends

The insights you get from looking at the past can help you plan for the future.

2. Use flexible forecasting models

An initial forecast can quickly fall apart in the face of change. One of the most useful small business forecasting strategies is to prepare for several scenarios. Do your small business budgeting for best-case and worst-case scenarios for tariffs, interest rates, inflation, supply chain upsets and varying energy rates.

Thinking through the implications means you’ll have the flexibility to react quickly. Planning for multiple scenarios will also help you identify where you can cut costs or bank financial buffers to weather challenges.

3. Plan for tariff and inventory impacts

How tariffs will affect the cost of goods imported from other countries is a matter of debate. For your business planning, it’s best to consider various scenarios, not just the one you think is most likely.

If tariffs are likely to put too much pressure on your margins, start negotiating with suppliers for better terms now. You can also look at diversifying your supplier base, so you aren’t stuck with just one source, to help protect you against supply chain disruptions. Both add operational resilience to your inventory management strategies.

4. Leverage AI to stay competitive

AI tools for small businesses can streamline tasks, surface hard-to-find information and perform some of the analysis that informs your small business budgeting strategies.

Using AI in forecasting and budgeting doesn’t replace your own knowledge and intelligence. It’s a tool for creating budgets around different scenarios. AI can also help your business save energy and control costs.

5. Conserve energy and budget for efficiency upgrades

Energy costs can influence your profit margins, and being energy-efficient can be a positive for your brand image, which is why conserving energy is important.

Budgeting for energy efficiency includes planning for:

- Upgraded lighting

- Energy-efficient appliances, devices and machines

- A new HVAC system

- Tools to monitor and optimize energy usage

Follow business energy saving tips and conduct energy budgeting to keep your small business costs more consistent and lower.

6. Include digital and IT investments in your budget

Technology can give you an operational and competitive advantage. Select hardware and software can boost productivity, reduce cybersecurity risks and even be more energy efficient. When your business keeps pace with digital advancements, you can better serve customers and run your operations more efficiently.

7. Develop your budget early and get approval before year-end

Start your small business budgeting process early. By analyzing 2025 data now, you still have time before the year ends to make adjustments.

Look at sales and expense trends to spot challenges before they carry into next year. You might also uncover a savings or growth opportunity to capitalize on now. This starts the new year with more momentum and less uncertainty.

Set realistic goals and stay flexible in changing market conditions

Small business budgeting requires a balance between being concrete and specific and being open and flexible. Both planning and sticking to your plan are important, but you must keep an eye on external forces (tariffs, the federal budget, energy markets) and your performance this year, so you can quickly adjust as needed.

Discipline helps keep your budget on track, but flexibility makes sure you can adjust when conditions change. A conservative approach to forecasting is often wise, given the pace of today’s business environment. Stay alert for new opportunities and prepare for potential challenges.

One way to add stability to your financial planning is by choosing a fixed-rate energy plan from Constellation, which helps protect your business from sudden swings in energy costs. By locking in predictable rates, you can focus more on growth and less on market uncertainty.