- Category:

Small Business Energy Savings -

Last updated:

November 26, 2025

Year-End Checklist for Small Businesses

A small business year-end checklist will help you make the most of the weeks counting down to the end of the year.

Take a moment to pause and consider what still needs to be done for a solid start to the new year. You’re likely facing some essential tasks, like:

- Reconciling your bookkeeping

- Reviewing vendor and contractor records and tax forms

- Checking on your progress against the goals you set at the start of the year

During this busy time, you may also have demands on your time for family gatherings, upcoming holidays and personal finances. An end-of-year checklist for your small business makes sure nothing gets missed.

What’s the purpose of year-end planning?

End-of-year planning is the process of reviewing how your business performed this year, then charting a path to success in the coming year. It involves looking into what did and didn’t work, and where you can make improvements.

Assessing your financial performance, operational efficiency and how well your team functioned shows you where to invest time and energy to strengthen your business.

A checklist helps small business owners keep track of year-end activities and is a useful tool when making a year-end plan.

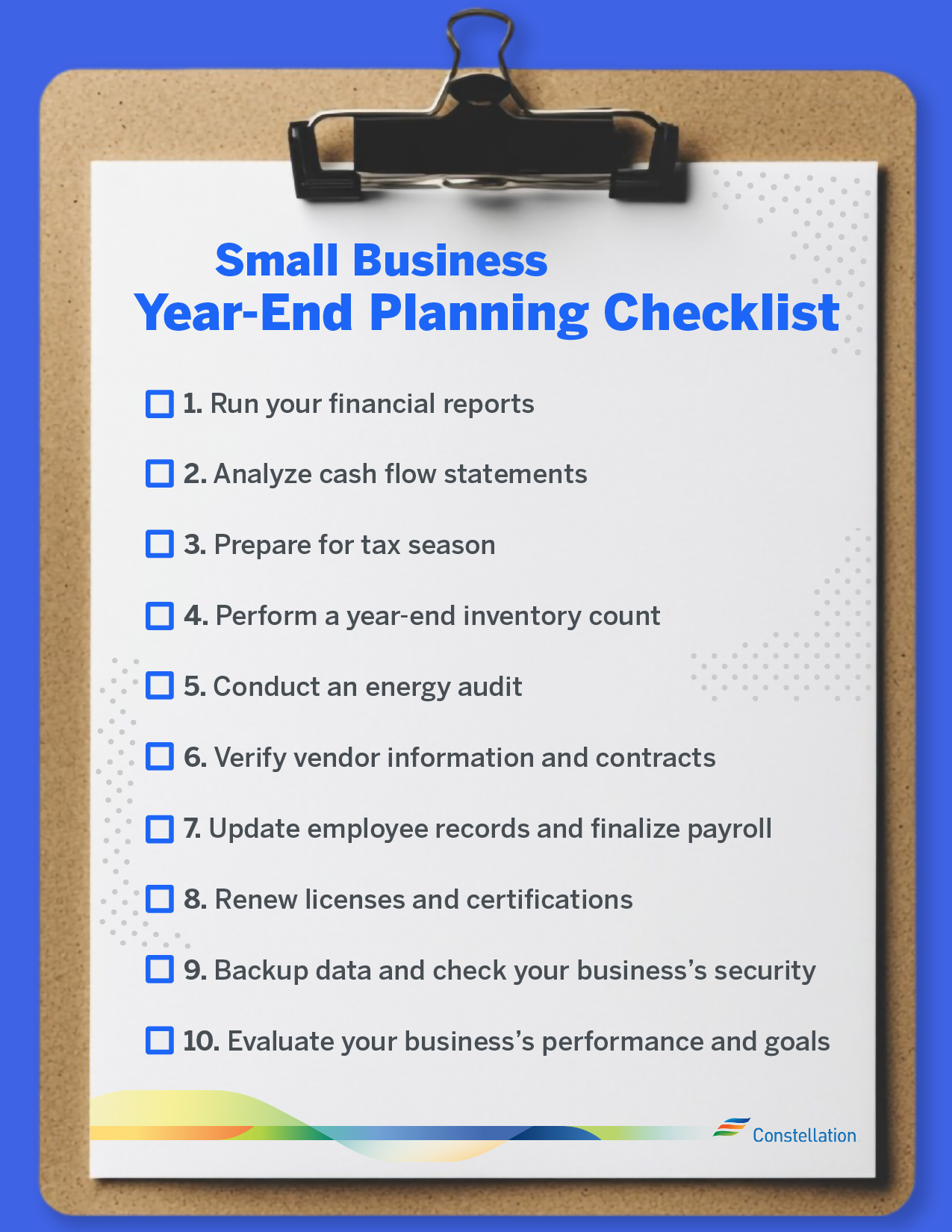

Small business year-end planning checklist

What should be on your year-end checklist for your small business? The details depend on your industry, market and situation.

Consider the following 10 actions as the outline of a year-end checklist template that you can customize to suit your specific needs.

Download the year-end checklist (PDF)

1. Run your financial reports

Start with your business finances. Look at your income statement to understand profitability, your balance sheet to measure liquidity and your cash flow statement to see your ability to cover expenses.

Doing this early in the fourth quarter gives you time to make changes, complete reconciliations and post accruals and deferrals. Clean, verifiable numbers will ease tax prep efforts and empower you to make good decisions for the coming year.

2. Analyze cash flow statements

Take a deep dive into your cash flow statement. Analyze how money moved through your business to spot patterns and trends.

While eyeballing your cash flow statement is a good start, try AI-powered analytics tools to uncover opportunities you might have missed and get suggestions about where to reallocate or save resources.

Having money at the right time affects your ability to pay bills, make investments and finance growth. Spending time on cash flow analysis now boosts your ability to see issues before they negatively impact you.

3. Prepare for tax season

Tax season will be less time-consuming and anxiety-ridden if you prepare for it. Organized year-end financial data will help you easily track down deductions, allocate purchases to the right expense categories and document income.

Set calendar reminders for filing deadlines, such as getting W-2 and 1099-NEC forms done before Jan. 31. With solid preparation, you can avoid penalties and interest.

4. Perform a year-end inventory count

Taking inventory is vital to understanding what’s on your shelves or in stock. You can see where your capital is tied up. And by comparing purchase records to your physical count, you spot shrinkage and data-entry errors.

If your business doesn’t carry inventory, take the time to audit your tools and equipment. Review software, subscriptions and service delivery plans, from cleaning to IT to professional services, to eliminate waste and cut unnecessary costs.

Explore inventory management tips that can make the process as smooth as possible with the most accurate results.

5. Conduct an energy audit

You can conduct an energy audit any time, but including it in an end-of-year checklist for small businesses ensures you perform this valuable task at least annually.

An energy audit habit is a great way to focus on improving efficiency and reducing expenses.

- Start with a review of monthly utility bills to identify patterns and verify your plan still fits your needs.

- Check equipment performance, especially your HVAC, refrigeration and appliances.

- Also check machinery or devices that consume high levels of power.

- Tour your facilities, looking for insulation, gaps and cracks around doors and windows that might be leaking heat or cool air.

If you can’t do it yourself, a professional inspection can give you savings that are well worth the effort.

6. Verify vendor information and contracts

Verifying information accuracy now means less of a scramble during tax season. It also helps you uncover opportunities for lowering expenses.

- Ensure that vendor and contractor files are complete, correct and comply with regulations.

- Chase down missing or outdated W-9 forms.

- Identify which vendor and contractor billing meets 1099-NEC reporting thresholds.

- Take a second look at all contracts to make sure you’re only paying for what you need, and see if you can find better options.

- Make sure certificates of insurance (COIs) are valid and current.

- Verify that automotive and business insurance policy terms and pricing meet your needs. You may be able to renegotiate them for a better deal.

7. Update employee records and finalize payroll

Examine employee records to make sure names, addresses and tax information are accurate and up-to-date.

People get married and divorced, move, change roles, get promoted and make different benefit selections over the course of a year. Processing year-end bonuses, finalizing payroll taxes and W-2s and updating benefits requires correct records.

This is also a good time for end-of-year planning around new benefits or payroll changes.

8. Renew licenses and certifications

Your business may be required to maintain certain licenses, permits and certifications. Many of these must be renewed annually. Commonly required documents are:

- Business licenses

- Sales tax permits

- Doing business as (DBA) registration

- Professional licenses

Check when each one must be renewed to avoid fines or business disruption due to non-compliance.

9. Back up data and check your business’s security

Another habit to add to your small business year-end checklist is backing up data to an off-site location.

You probably have a regular, ongoing backup process. But a formal, year-end backup is a good way to protect your business from lost, corrupted or stolen data during one of the year’s busiest seasons.

Conducting an annual security audit:

- Safeguards your data and systems

- Uncovers vulnerabilities to fix

- Keeps you in compliance with cybersecurity regulations

This is also a good time to inventory devices and check the security roles and permissions of staff and contractors.

10. Evaluate your business’s performance and goals

Round out your year-end checklist template with planning for the new year.

Analyze data from the previous year to evaluate how your business performed. Compare your results with your plans and goals.

- What went well?

- What didn’t?

- Were there unforeseen business costs?

- Did you meet your targets?

- How did you do overall?

- Are there opportunities you missed?

The answers to these questions will guide end-of-year planning and help you uncover growth and profit opportunities in the coming year.

Planning for small business success in the new year

After completing the year-end checklist for your small business, shift from reflection to preparation. Year-end activities for small business owners should include small business budgeting and forecasting for 2026.

Do you have:

- Any unusual expenses on the horizon?

- Cost increases to manage?

- Tax changes that affect profitability?

- Expected revenue growth or new product lines launching?

- The need to invest in new equipment?

Planning for these now will help you protect your small business. You can also take this opportunity to switch to commercial LED lighting or make small business technology upgrades to help save energy, lower utility bills and/or improve efficiency.

If you don’t know where to start, Constellation can help. Our business development managers can help you find an energy plan that makes sense for your business and energy goals.