- Category:

Small Business Energy Savings -

Last updated:

July 30, 2025

Small Business Budgeting for Emergencies

Small business budgeting for emergencies prepares your company for the unexpected. When a natural disaster, disruption in your supply chain, civil unrest or sudden change in consumer demand strikes, you don’t want your company to be financially vulnerable.

According to a recent U.S. Chamber of Commerce study, 27% of small businesses report they are one crisis away from business failure. A FEMA study reports that 40% of businesses don’t reopen after a disaster, with 25% more failing within a year.

Budgeting for emergency preparedness is a way for your company to defy those statistics — to survive and even thrive. This article contains tips on disaster budgeting for businesses that will give you the resiliency you need, come what may.

What is a small business emergency fund?

A small business emergency fund is a savings account for money you set aside in case of an emergency. This money is kept separate from your transactional accounts, like your checking account and regular savings account. You should make regular contributions to it so that you build up enough reserves for events that threaten the survival of your business. What counts as an emergency varies, but what to prepare for includes:

- Natural disasters, like hurricanes, tornadoes, floods or wildfires

- Manmade disasters, like a vehicle crashing into your business, break-ins, rioting or arson

- Critical equipment failure

- Digital attacks, like stealing data or shutting your systems down with ransomware

- Medical emergencies of key employees, including you

- Building system failures such as broken pipes, HVAC issues and power outages

- Lawsuits that range from customer injuries to breached contracts

- Economic downturns, recessions or loss of a key client

- Pandemics and government-mandated shutdowns

The importance of budgeting for emergency preparedness

It’s important to combine emergency budgeting for businesses with setting up a small business emergency fund. Having both a plan and financial resources will help you get through tough times. You will have some peace of mind to respond without panic, and ready money to give you flexibility. Here are the key benefits of such an approach:

- Protects against emergencies: Your emergency fund can cover sudden expenses without waiting for insurance or scrambling for help from others.

- Increases your business’s stability: A financial cushion and thoughtful way forward helps you maintain operations and relationships with employees, vendors, investors and customers.

- Reduces the need for financing: You won’t have to use your high-interest credit card or apply for a loan when you have an emergency fund ready.

- Creates confidence and a professional image: Being able to move forward reassures employees, customers, vendors and investors and conveys an image of proactive management and a well-managed business.

- Sets you up for better long-term planning: When you can take emergency plans and finances off the table, you can focus on growth strategies with less worry about unexpected setbacks.

- Speeds recovery: If you can act right away to reopen your doors and re-engage with customers without having to wait for an insurance payout, federal support or a loan to close, your business can bounce back more quickly.

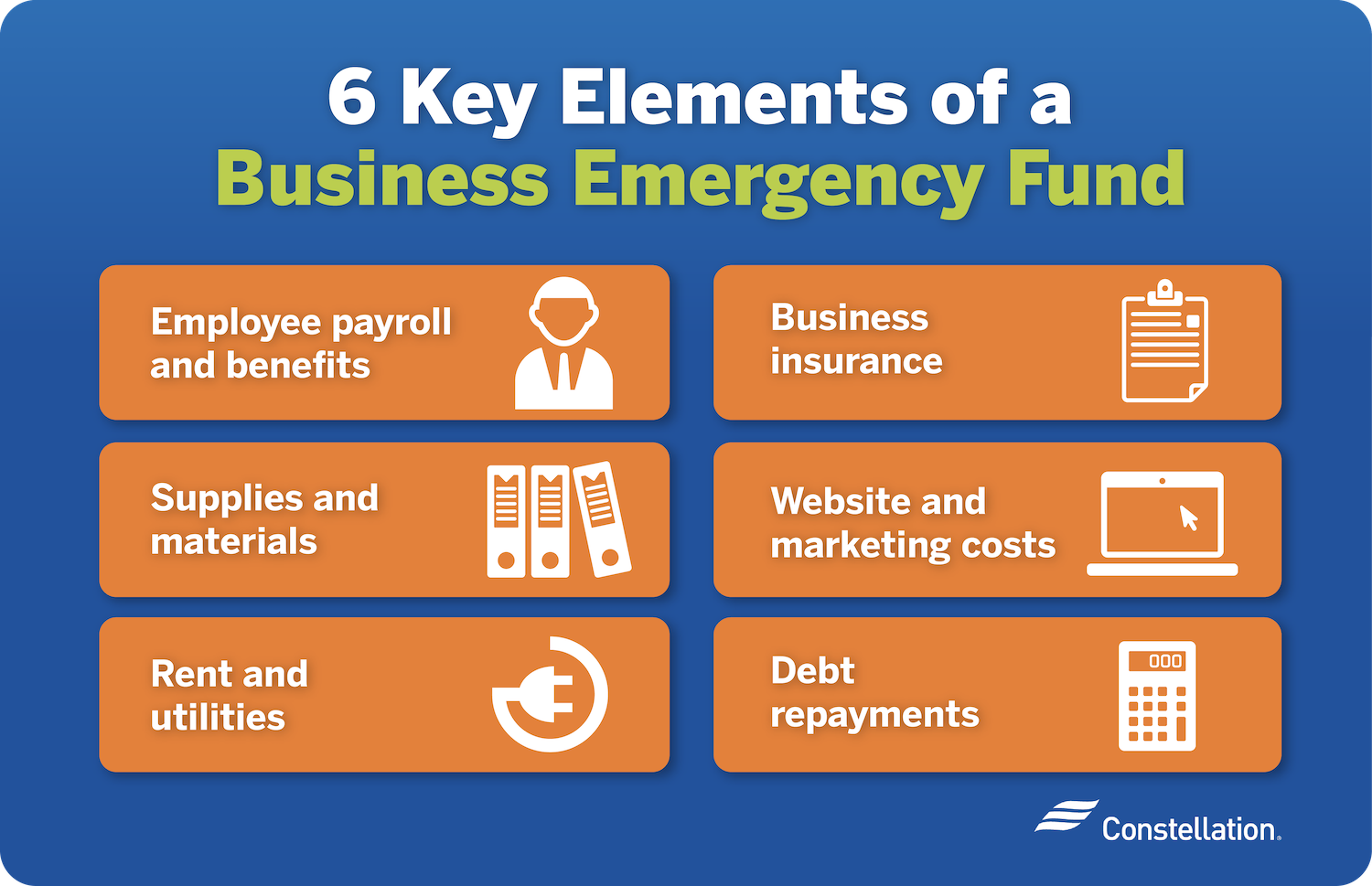

What should an emergency budget for businesses include?

The line items in your emergency budget will depend on your business and situation, but below are some basics to consider. Identifying what you need and estimating expenses ahead of time will help you with planning.

Employee payroll and benefits

Payroll is one of the biggest expenses. Making sure your team still gets paid during a disruption has an enormous emotional impact. If your people feel secure, you’re better able to keep them, keep them focused and keep your operations running. Be sure to fund key benefits as well, and invest in training for disaster preparedness.

Supplies and materials

Shipments might get delayed or destroyed, and you might lose on-hand inventory in an emergency. Having some backup stock, ideally off-site, can keep your business running even with a disrupted supply chain. You might also set aside backup equipment and budget for replacements.

Rent and utilities

While landlords and utilities may offer some temporary flexibility during a disaster, you will eventually have to start paying. In fact, you may have higher-than-normal expenses if you must rent temporary space and HVAC equipment while your building and systems are repaired. Plan on needing to cover two or three months of rent and utility costs.

Business insurance

The insurance safety net is not complete. You’ll need ready cash for deductibles, gaps in coverage and to keep going while waiting for a payout, which could take some time. Study your policies and add additional coverage and possible business interruption insurance. Then budget cash to bridge the time to payouts and to cover out-of-pocket expenses.

Website and marketing costs

Communication with customers, employees and vendors is vital during and after an emergency. Don’t think of marketing as just promotion. It’s everything you do to keep people informed and to keep operating. You might suspend your regular promotions to talk about new hours, services, locations and processes. Your website, social media and other channels help keep information flowing to build trust and maintain continuity.

Debt repayments

Payments need to be made on schedule for your loans and credit cards, or you risk penalties, higher interest rates, damage to your credit rating and possibly foreclosure or repossession. Budget to have enough cash on hand to cover at least the minimums. This will buy you time to renegotiate terms or refinance on solid footing.

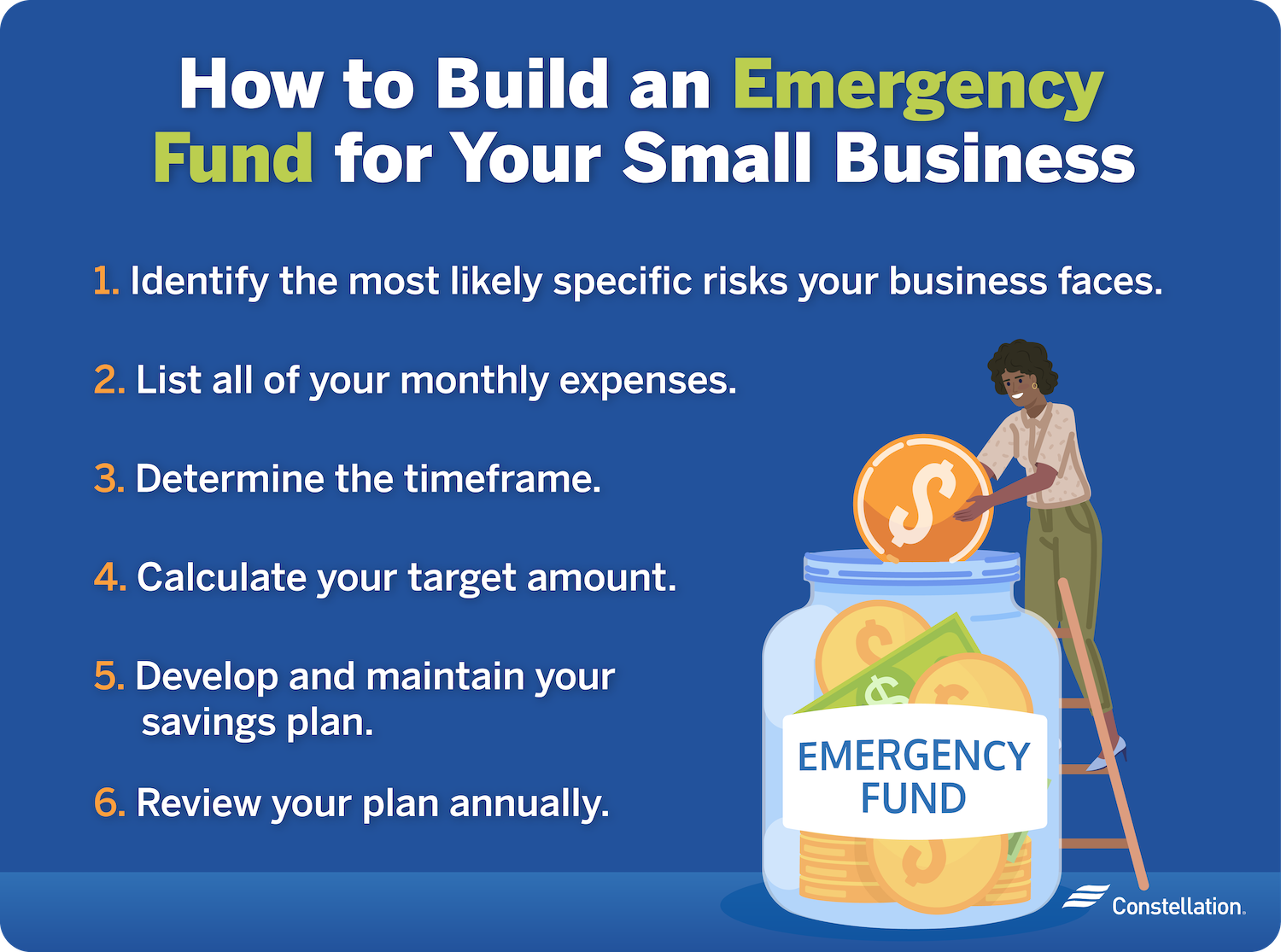

How to create a small business emergency fund

With emergency budgeting for small businesses complete, your next step is to set up your small business emergency fund. A business budget plan for emergencies will help you answer some of the most critical questions, starting with how much money you need to set aside. Follow these steps:

- Identify the most likely specific risks your business faces. You can’t anticipate everything, but if your business is on the beach in Florida, you need to think about hurricanes. If your business is in the plains of Nebraska, tornadoes are more likely.

- List all of your monthly expenses. Identify your essential operating costs to get a clear picture of what it will take to keep going for a month.

- Determine the timeframe. The type of disaster affects how long your business will be disrupted. Aim for at least enough money to cover three months and build toward six months.

- Calculate your target amount. With an idea of your monthly expenses and the timeframe for having what you need in your basic small business emergency fund, you can determine your target amount to save.

- Develop and maintain your savings plan. Funding is the hard part. Develop a savings strategy for putting aside a fixed amount every month and consider earmarking a percentage of any surplus revenue for your emergency fund. Be serious and disciplined about contributing to it regularly.

- Review your plan annually. Review your strategy, plans and savings at least yearly. Reassess your risks, update estimated expenses and rethink your savings target goal.

Protect your business by planning ahead

Small business budgeting for emergencies is how you can be proactive in taming some of the uncertainties of business. Being operationally and financially prepared is a smart investment.

Learn more about how to create a comprehensive small business emergency and natural disaster plan, budget and fund with our resources for disaster planning.